philadelphia wage tax rate

Ad Based On Circumstances You May Already Qualify For Tax Relief. But for the 2023 fiscal year the City of Philadelphia is reducing that tax rate to the lowest its been in five decades.

Philadelphia City Council Approves Business And Wage Tax Cuts In 5 6b Budget Deal Philadelphia Business Journal

Here are the new rates.

. 307 Median household income. Ad Compare Your 2022 Tax Bracket vs. December 17 2021.

Effective July 1 2022 the Philadelphia City Wage Tax will decrease for both residents and non-residents. Tax rate for nonresidents who work in Philadelphia. The new Wage Tax rate for residents is 38398.

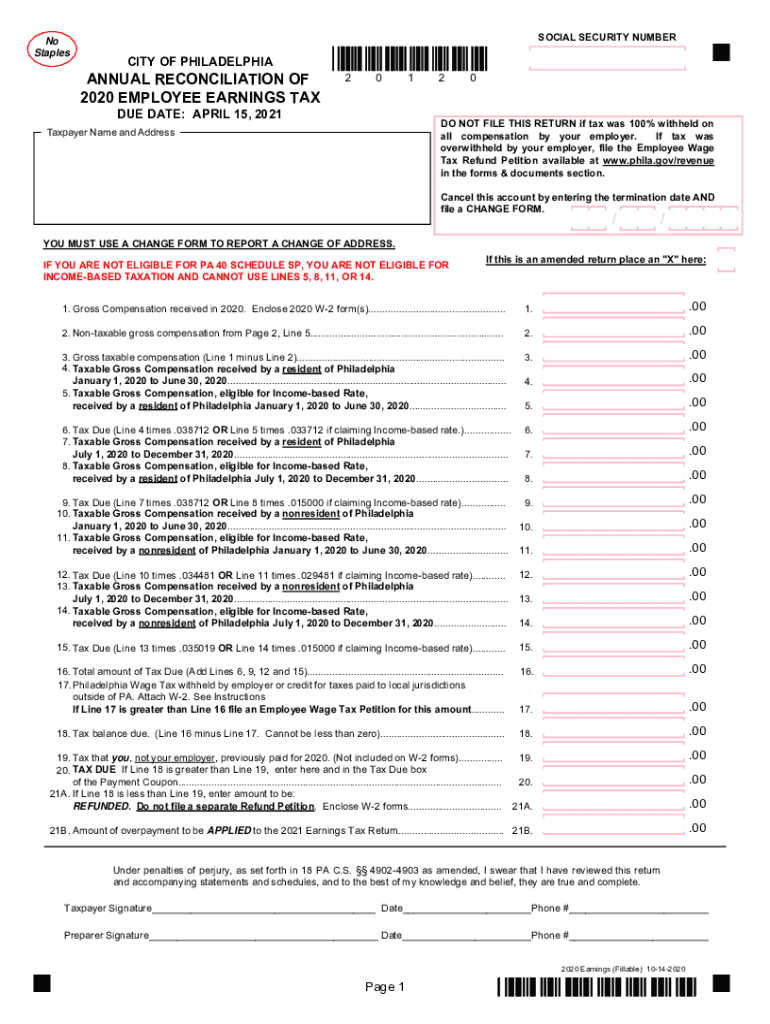

Non-residents who work in Philadelphia must also pay the Wage Tax. The Earnings Tax rates in the new fiscal year are therefore 38712 038712 for residents and 35019 035019 for non-residents. From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center.

45 percent on transfers to direct descendants and lineal heirs. The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. 344 0344 The non-resident City Wage Tax applies to those employed by a Philadelphia-based entity.

Census Bureau Number of municipalities and school districts that have local income taxes. The new BIRT income tax rate becomes effective for tax year 2023 for returns due and taxes owed in 2024. The main difference is how the tax is collected and paid to the City of Philadelphia.

Starting on July 1 the. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax.

It also lowered the Business Income and Receipts Tax BIRT tax from 62 to 599. The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. See below to determine your filing frequency.

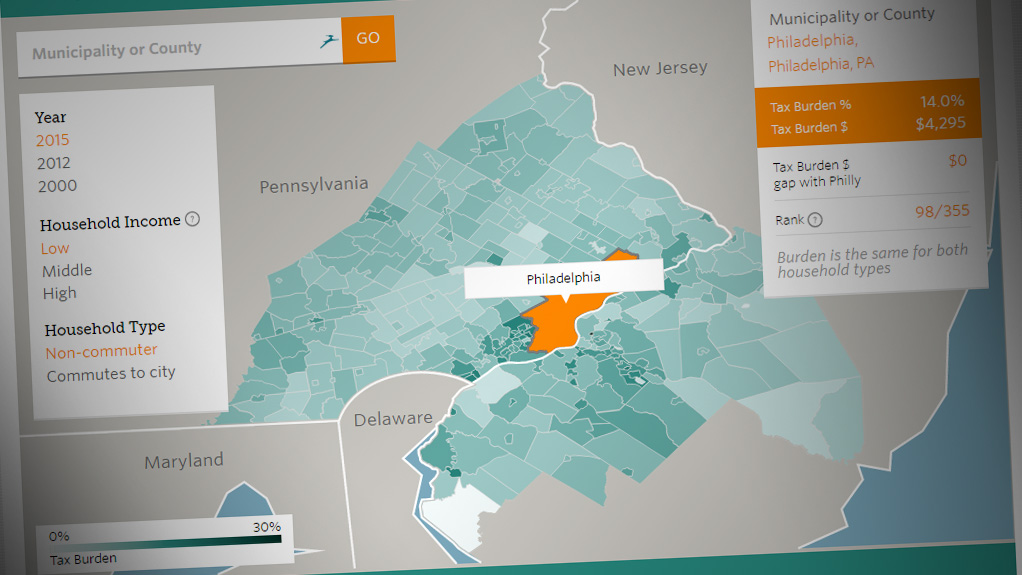

The Earnings Tax rate for residents is also decreasing from 38712 to 38398. Find out if you are eligible for an income-based Wage Tax refund. The City of Philadelphias tax rate schedule since 1952.

Wage and Earnings taxes. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now. The Earnings Tax rate for residents is also decreasing from 38712 to 38398.

For specific deadlines see important dates below. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. 2022-2023 Philadelphia City Wage Tax Rate.

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. The new Wage Tax rate for residents is 38398. Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent.

379 0379 Wage Tax for Non-residents of Philadelphia. The new NPT and SIT rates are applicable to income earned in Tax Year 2022 for returns due and taxes owed in 2023. Free Case Review Begin Online.

Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now. The new Wage Tax rate for residents is 38398The Earnings Tax rate. With that household income youd pay 1886 per.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. In addition non-residents who work in Philadelphia are required to pay the Wage Tax. Earnings Tax employees Due date.

The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks. The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. It is just a 0008 decrease in wage tax.

Use code enforcement numbers to request a payoff. This change must be in place for all. 12 percent on transfers to siblings.

For residents and 344 for non-residents. The Earnings Tax rate for residents is also decreasing from 38712 to 38398. Resolve bills or liens for work done by the City on a property.

For non-residents the savings are even more minuscule. Quarterly plus an annual reconciliation. Resolve business and incomeWage Tax liens and judgments.

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. Pennsylvania income tax rate. See If You Qualify For IRS Fresh Start Program.

As of July 1 2019 the Wage Tax rate for Philadelphia residents is 38712 and 34481 for non-residents its lowest since 1976. Based on the average median household income in Philadelphia of around 49k thats a savings of about 47 cents per week. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

Birth marriage life events. Here are the new rates. On Thursday Philadelphia City Council voted to reduce wage taxes to 379 from 387 for residents and 344 from 345 for non-residents.

Employers collect the Wage Tax from a workers paycheck and remit it to the. Inheritance and Estate Tax. Here are the new rates.

For residents of Philadelphia or 344 for non-residents. Wage Tax for Residents of Philadelphia. The Earnings Tax rate for residents is also decreasing from 38712 to 38398.

The new Wage Tax rate for residents is 38398. Changes to the Wage and Earnings tax rates become effective July 1 2022. All Philadelphia residents owe the City Wage Tax regardless of where they work.

For non-residents the Wage Tax applies to compensation for work or services. Discover Helpful Information And Resources On Taxes From AARP. 15 percent on transfers to other heirs except charitable organizations.

The wage tax rate is set to drop from 384 to 379 for resident city workers. Your 2021 Tax Bracket To See Whats Been Adjusted. Here are the new rates.

The Earnings Tax closely resembles the Wage Tax. Here are the new rates. People who meet the criteria can receive a refund of up to 05 on City Wage Taxes that their employer withheld from their paychecks.

Business self-employment. The new Wage Tax rate for residents is 38398. The wage tax rate is set to drop from 384 to 379 for city workers and the median annual household income for Philadelphia is about 49k.

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

Philly City Council Reaches Budget Deal With Tax Relief Whyy

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

Philadelphia City Council Approves Business Wage Tax Cuts In 5 6b Budget Deal Nbc10 Philadelphia

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

2020 Philadelphia Tax Rates Due Dates And Filing Tips

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Approval Of Business And Wage Tax Cuts Hailed As Turning Point By Philadelphia Business Leaders Philadelphia Business Journal

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia